What Are You Really Paying For?: ConocoPhillips NAV Breakdown

Unpacking ConocoPhillips’ Asset Value to Reveal the True Floor of Its Stock Price

Are investors pouring money into a broken well — or positioning themselves for future wealth?

ConocoPhillips, a global upstream powerhouse, trades at a valuation that begs the question: is the market pricing in solid, tangible assets… or is it betting on growth and operational excellence yet to be realized?

In this article, we strip away the hype and focus on the bedrock — the Net Asset Value (NAV) — to reveal what you’re really paying for.

Don’t miss Part 2 — where we unpack ConocoPhillips’ strategic outlook and alternative valuation models to see if the market price holds up. [Subscribe now] to get it delivered straight to your inbox!

Business & Industry Overview

As of year-end 2024, ConocoPhillips stands as one of the world’s largest independent E&P companies, with operations across North America, the Middle East, Asia, and Europe. The company focuses exclusively on upstream oil and gas production, without exposure to midstream or refining segments. This pure-play model sharpens capital efficiency but also concentrates commodity price exposure.

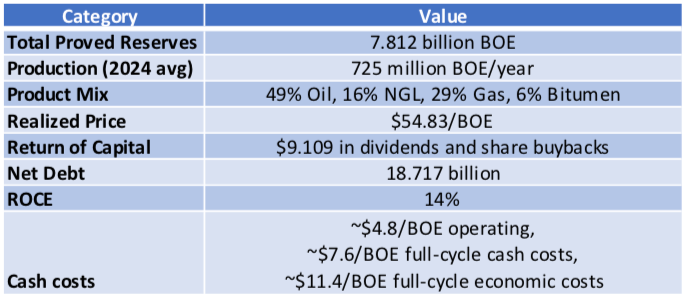

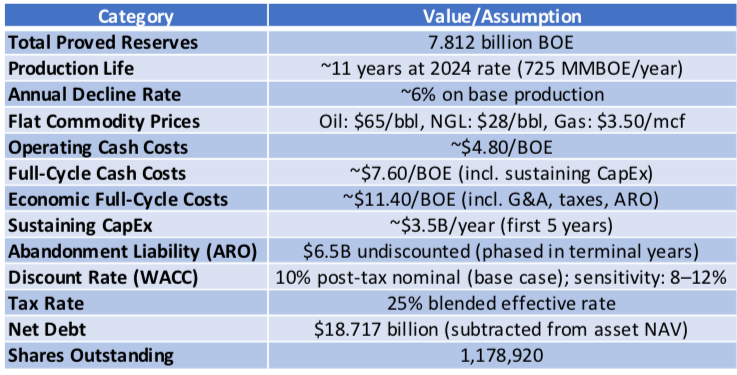

Forecast Assumptions

To estimate intrinsic value, we apply a reserve-based valuation using the PV-10 methodology (Present Value of estimated future net revenues, discounted at 10%). Since Conoco does not publish PV-10 segmented by field, we rely on market-consistent estimates for total proved reserves and apply reasonable assumptions for:

Three scenarios were tested:

Conservative: Lower price deck and reserve estimates

Base Case: Market-consistent price and reserve assumptions

Aggressive: Higher prices and additional resource conversion

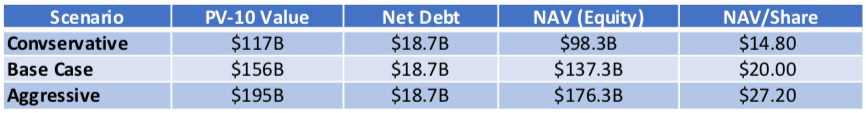

NAV Model Output

Interpretation (as of June 6, 2025, close: $87.22/share)

At $87.22, ConocoPhillips trades at:

4.4x NAV/share (Base Case)

3.2x NAV/share (Aggressive Case)

5.9x NAV/share (Conservative Case)

This premium reflects strong investor confidence in:

Unbooked Upside — Probable reserves, contingent resources, and future inventory not captured in PV-10.

Tier-One Asset Portfolio — High-margin barrels from Willow, Surmont, Montney, and Qatar.

Capital Discipline — With low full-cycle cash costs (~$7.6/BOE), Conoco generates strong free cash flow even at modest oil prices.

Management and Scale — Investors are assigning value to execution, capital efficiency, and global diversification.

Understanding the NAV Gap

At $87/share (market price as of June 6), ConocoPhillips trades well above its estimated NAV/share of $20 (base case). This gap is not a modeling error — it reflects the limitations of traditional PV-10-based NAV models.

NAV is based solely on proved reserves and does not capture:

Unbooked resources (probable reserves, contingent resources)

New development projects (e.g., Willow, Qatar, Surmont upside)

Operational excellence and capital allocation quality

Optionality at higher oil prices and long-duration free cash flow

The market prices in future growth, premium assets, and strategic execution — elements that are excluded from the conservative PV-10 framework.

In short: NAV provides a floor, not a ceiling — a valuable reference, but not a full measure of equity value.

Capital Structure Implications

Despite substantial shareholder payouts, Conoco maintains a conservative leverage profile:

Net debt / EBITDA (2024): ~0.6x

Interest Coverage (EBIT / Interest): ~21x

Credit rating: A / A3 (S&P / Moody’s)

📌 Interpretation: The NAV-derived equity value is effectively fully attributable to shareholders, not debtholders — a critical strength when comparing Conoco against peers with higher leverage, heavier refining exposure, or integrated business models.

This strong balance sheet reflects disciplined capital allocation, resilient cash flows, and minimal refinancing risk.

Coming in Part 2: Strategic Takeaways & Investment Thesis

We explore whether ConocoPhillips deserves its valuation premium — or if investors are overpaying for future upside. We’ll examine growth drivers, resource replacement, and what other models like DCF and comparables say about valuation.

Ready to invest smarter in energy? Subscribe today for exclusive, in-depth analysis that goes beyond the surface — get ahead with Petro Symposium’s expert insights. [Subscribe here]

ConocoPhillips Q1 2025 Earnings:

ConocoPhillips. (2025, May 8). ConocoPhillips announces first-quarter 2025 results. Yahoo Finance. https://finance.yahoo.com/news/conocophillips-announces-first-quarter-2025-110000983.html

ConocoPhillips 2024 Annual Report:

ConocoPhillips. (2025). 2024 Annual Report. https://www.conocophillips.com/company-reports-resources/annual-report/

ConocoPhillips Stock Information:

Yahoo Finance. (2025). ConocoPhillips (COP) Stock Price, News, Quote & History. https://finance.yahoo.com/quote/COP/