U.S. Oil Market Weekly: Tight Crude, Soft Products – A Summer of Divergence

Tightening Crude Supplies Meet Softening Fuel Demand: What’s Next for U.S. Oil Markets?

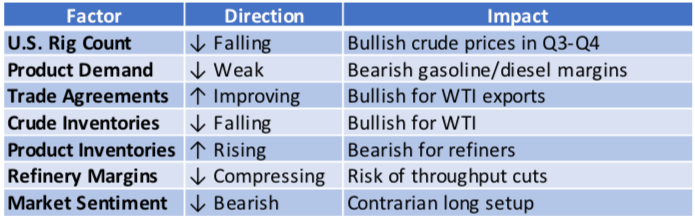

The latest U.S. petroleum data reveals a critical split: crude oil supply fundamentals tighten while product demand softens. This upstream-downstream divergence has important implications for prices, refinery margins, and near-term market direction.

Refining Activity & Imports: Signs of Resilience and Tightness

U.S. refinery crude inputs rose sharply to 17 million barrels per day, operating at 93.4% capacity, reflecting seasonal ramp-ups heading into summer driving season. Yet imports declined nearly 10% YoY, indicating tighter crude availability domestically.

My take: The steady decline in imports amid strong refinery runs suggests a supply crunch forming for crude barrels in the U.S., which could provide near-term support for WTI prices. Domestic producers and shale operators are likely benefiting from this tighter environment.

Upgrade to PetroSymposium Premium to access exclusive forecast models, deep-dive valuation reports, and macro strategy notes — everything you need to stay ahead in energy markets. Subscribe now and gain the edge.

Inventories Paint a Mixed Picture

Crude inventories dropped by 4.3 million barrels, hitting 7% below the 5-year average — a clear bullish signal for crude fundamentals.

Conversely, inventories for gasoline and distillates increased significantly, signaling weaker demand or slower throughput downstream.

My take: The crude draws affirm tightening supply, but growing product stocks raise red flags about consumer and industrial fuel demand. This may reflect early signs of economic slowdown or increased fuel efficiency, keeping a lid on gasoline and diesel prices.

Demand Trends Remain Soft

Product supplied data over the past four weeks show declines across the board compared to last year:

Gasoline down 3.1%

Distillates down 4.3%

Jet fuel down 2.2%

My take: Persistent demand weakness amid high refinery utilization suggests inventory builds could intensify, pressuring downstream margins and capping fuel price rallies in the near term.

Retail Prices Reflect Inventory Pressure

Gasoline and diesel retail prices continue to slide YoY by over 7-11%, mirroring the inventory and demand data:

Gasoline: $3.127/gal (down $0.389 YoY)

Diesel: $3.451/gal (down $0.275 YoY)

My take: Retail price weakness not only signals soft consumption but could also dampen refinery cash flows, making some refining capacity less economically viable if the trend continues.

Adding Depth: Macro Risks, Trade Dynamics, and Supply Lag

1. Rig Count and Supply Lag

The Baker Hughes rig count has steadily declined, hinting at reduced future production. With shale producers emphasizing capital discipline, output recovery may lag even if prices rebound. This sets the stage for a supply squeeze if demand picks up.

We are entering a window where current oversupply coexists with future undersupply risk. That’s a textbook setup for crude oil price volatility.

2. U.S.-China Trade Diplomacy

New trade agreements between the U.S. and China could expand crude export capacity, offering relief to domestic crude inventory builds. Improved diplomatic ties enhance the long-term outlet for U.S. barrels.

Trade diplomacy becomes a supply valve. When outlets expand, crude tightness translates more directly into higher WTI pricing.

3. Refinery Margin Compression Risk

High throughput and soft product demand compress crack spreads. If refiners start to pull back runs, it could trigger new builds in crude inventories, reversing current bullish trends.

Refiners are the bridge between upstream optimism and downstream reality. If they throttle back, bullish crude sentiment could face headwinds.

4. Market Sentiment Divergence

Current narratives center on weak product demand and falling fuel prices, but they overlook:

Lower U.S. rig counts

Rising export potential

Tight inventories

Potential OPEC+ supply discipline

This divergence between spot weakness and forward tightening may lead to a mispricing opportunity.

Strategic Forecast: Summer 2025

My revised forecast:

WTI to trade in a $65–75 range, with potential breakout toward $80 if product draws resume.

Refiners will closely manage throughput to protect margins.

Retail gasoline prices may remain under pressure through summer unless economic growth revives sharply.

Ironically, today’s pessimism may be sowing the seeds for tomorrow’s bullish crude rally. Stay contrarian, but tactical.

WTI vs. Brent Divergence Outlook

While both WTI and Brent face global macro headwinds, the U.S.-specific factors — including tightening domestic supply, falling rig counts, and improving trade diplomacy — suggest that WTI may have a stronger near-term upside case than Brent. Conversely, OPEC+ supply risks and quota inconsistencies could weigh more heavily on Brent.

Net view: In a market priced for product weakness, WTI may surprise to the upside — especially if crude fundamentals tighten further while Brent contends with supply risk from within.

U.S. Energy Information Administration. (2025). Weekly petroleum status report. U.S. Department of Energy. https://www.eia.gov/petroleum/supply/weekly/