Colombia’s Economic Outlook 2024–2026: Navigating Recovery Amid Fiscal Challenge

Gradual Growth, Persistent Inflation, and the Need for Structural Reform in a Shifting Global Landscape

Introduction

Colombia's economic recovery remains gradual as the country navigates post-pandemic challenges, global uncertainty, and internal structural weaknesses. The OECD Economic Outlook for December 2024 highlights both encouraging signs of resilience—such as a stable labor market and rebounding investment—and persistent vulnerabilities, including widening fiscal deficits and slow disinflation. This report provides a comprehensive overview of Colombia’s short- and medium-term economic prospects, the fiscal and monetary policy environment, and the key risks that could affect its growth trajectory.

Colombia – OECD Economic Outlook, December 2024

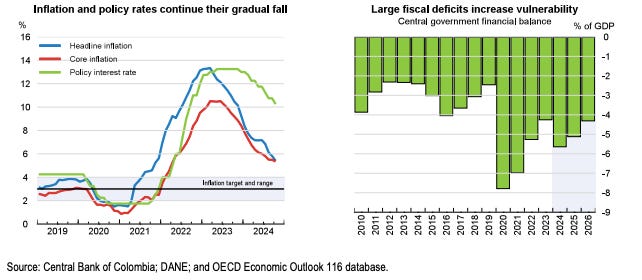

According to the OECD Economic Outlook for December 2024, Colombia's economy is projected to grow by 1.8% in 2024, followed by a recovery of 2.7% in 2025 and 2.9% in 2026. Investment activity is expected to pick up as financial conditions ease, though it will remain below pre-pandemic levels due to persistent uncertainty. Consumption is forecast to grow modestly, while export growth remains robust. Inflation is projected to decline gradually—reflecting high levels of price indexation—with the 3% target anticipated to be met by the end of 2026. However, increasing fiscal and current account deficits pose significant risks to this outlook.

Cautious Easing of Monetary Policy Needed

Monetary policy is expected to continue easing, but gradually and cautiously. With high planned fiscal deficits and recent revenue shortfalls leaving little room for risk, fiscal prudence and strict adherence to the fiscal rule are essential. Reducing budget rigidities and implementing tax reform will be necessary to shift the tax burden from corporate to personal income, reduce tax expenditures, simplify the tax system, and combat tax evasion.

Growth Rebounding

Between January and September 2024, Colombia’s output grew at an annual rate of 1.6%, up from 0.6% in 2023. Investment is beginning to recover, although the overall investment rate remains low. The labor market has proven resilient despite economic uncertainty, with unemployment around 10%—a historically low rate for Colombia—which has supported private consumption. Inflation has continued to decline gradually, reaching 5.4% in October.

Fiscal Revenue Pressures and External Factors

Lower gas prices continue to weigh on export and budget revenues, though fiscal receipts may improve due to the introduction of a surtax on extractive industries. Remittances remain strong, bolstered by favorable economic conditions in key diaspora countries like Spain and the United States. These inflows are helping support both household consumption and the current account. Meanwhile, tight electricity markets—exacerbated by adverse weather—continue to present supply challenges.

Fiscal Deficit Risks

The fiscal deficit is projected to widen from 4.3% of GDP in 2023 to 5.6% in 2024, and to remain above 4% through 2026, in line with the government's fiscal rule. However, there is a risk that revenue shortfalls—stemming from unlegislated tax measures and unrealized gains from improved tax administration—may force the government to adopt ad-hoc spending cuts, potentially affecting public investment in 2025.

Monetary policy remains restrictive, with the policy rate at 9.75% as of November. The central bank is expected to continue its easing cycle gradually. The real neutral interest rate—estimated at around 2.5%—is expected to be reached by late 2026 when inflation aligns with the 3% target.

Moderate Growth Outlook

Economic growth is forecast to remain below 3% in both 2025 and 2026. As financial conditions normalize and the effects of previous shocks to housing and infrastructure fade, investment is expected to rise from a historic low of 17% of GDP to 19% in 2026, still below the pre-pandemic average of 21%. Consumption is expected to remain moderate, constrained by high household debt and sluggish credit growth. Unemployment is likely to remain near its current rate.

Exports will grow modestly, driven by external demand, although low oil prices may limit upside. At the same time, increased imports of investment goods could widen the current account deficit. Heightened domestic and global uncertainty may also place pressure on the exchange rate and interest rate spreads. Conversely, rising oil prices—especially due to geopolitical tensions—could enhance both export and fiscal revenues.

Colombia's vulnerability to external shocks is exacerbated by its fiscal and current account deficits. A proposed reform in Congress aims to increase the share of tax revenue allocated to subnational governments, which could create fiscal imbalances unless local governments strengthen their capacity. The accelerated implementation of reindustrialization and energy transition policies may also provide a boost to investment.

Conclusion

Colombia is entering a phase of cautious recovery, with modest growth expected to continue over the next two years. To support this momentum and reduce vulnerability to external shocks, fiscal discipline, structural reforms, and targeted investments are essential. Tax reform and better subnational fiscal management will be critical to improving revenue generation and ensuring more balanced public spending. While external conditions such as commodity prices and global interest rates will influence the outlook, sound domestic policies and the successful implementation of planned reforms will ultimately determine Colombia’s ability to sustain inclusive and stable growth.

OECD. (2024). Colombia. In OECD Economic Outlook, Volume 2024 Issue 2. OECD Publishing. Retrieved from https://www.oecd.org/en/publications/oecd-economic-outlook-volume-2024-issue-2_d8814e8b-en/full-report/colombia_3c64b685.html#indicator-d1e5472-b07c47d29f